Paper checks are officially on the way out. As of September 30, 2025, the federal government will no longer send paper checks for benefits such as Social Security payments, tax refunds, or other government payments. Instead, everything will move to direct deposit or a prepaid card.

For some, this change feels overdue—direct deposit is faster, safer, and more reliable. But if you’re still using paper checks, don’t worry. We’re here to help you keep your wild dreams on track!

Here’s how to make the transition simple:

Step 1: Gather your Gerber FCU account info

You’ll need two things:

- Routing number

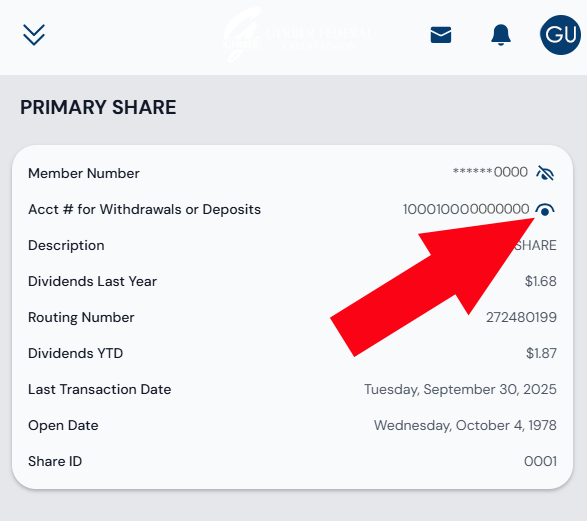

Our routing number is: 272480199. When you need it in the future, it’s always easy to find in your Gerber FCU app or at the bottom of our website.

- Your account number

In digital banking, tap the account you want to use and scroll to the bottom to view the account information. Tap the eye icon next to ‘Acct # for Withdrawals or Deposits’ to see the account number you’ll use for all direct deposits. This is what Social Security or the IRS will use to send your deposits directly.

Step 2: Update your federal information

Visit ssa.gov/deposit for Social Security or GoDirect.gov for tax refunds and enter your Gerber FCU account details from step 1. If you’d like, stop by a branch or give Member Service a call at (231) 924-4880 option 2 - we’ll be happy to walk you through it.

Step 3: Turn on digital banking alerts

With our digital banking, you can set up instant alerts to let you know when your deposit hits. No more waiting by the mailbox or wondering when the check will clear.

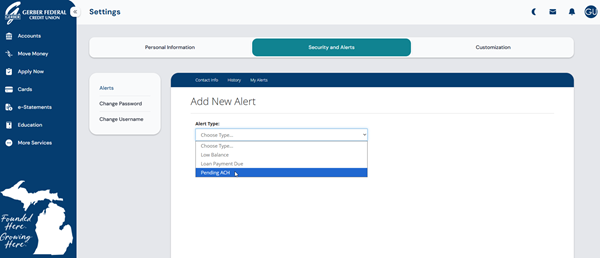

- Open digital banking and click the bell icon in the upper right corner.

- Tap ‘Security and Alerts’ on your desktop or ‘Manage Alerts’ from your smartphone and add the ‘Pending ACH’ alert. You can choose to receive your notification by eMail or Text Message.

Step 4: Ask for help anytime

We know change can feel overwhelming, but you don’t have to do this alone. Our team is here to make sure you’re set up and confident before paper checks disappear for good. Tap to see all the ways to contact us!

Why it matters

Switching to direct deposit isn’t just about compliance. It’s about speed, security, and convenience. Your money gets to you faster, without the risk of losing a check in the mail. And with our digital tools, you’re in control every step of the way.

The bottom line: Paper checks may be going away, but your money isn’t. We’ll make sure it always lands safely where it belongs - right in your account.